As geopolitical tensions escalate across the globe, particularly with the ongoing U.S.-Ukraine conflict and other international flashpoints, one commodity stands as the undisputed safe haven—gold. In times of uncertainty, investors flock to gold, driving up its price and making it one of the most resilient assets during economic and political volatility. Gold’s appeal as a store of value has been solidified over centuries, and in 2025, it has reached record-breaking highs, showcasing its ever-reliable role in financial markets.

Let’s delve deeper into why gold is flourishing in today’s market, its historical price trends, and what might lie ahead for gold prices as the world faces mounting geopolitical risks.

Gold as a Safe-Haven Asset: The Role of Geopolitical Tensions

Gold has long been viewed as a safe-haven asset—an investment that retains its value and even appreciates when other financial markets falter. This is particularly true during times of geopolitical uncertainty, as investors seek to protect their wealth from economic instability, inflation, or potential currency devaluation.

In 2025, as tensions rise between major global powers such as the U.S., NATO, Russia, and China, gold’s appeal as a defensive asset has surged. The ongoing war in Ukraine, along with the threat of escalating sanctions and trade wars, has led investors to hedge against the volatility in global markets by purchasing gold.

Historical Price Trends of Gold: A Store of Value Over Time

To understand why gold continues to command such attention, it is essential to look back at its price history. Historically, gold has maintained a steady increase in value, particularly in times of economic crisis and geopolitical unrest. Here’s a breakdown of its remarkable journey:

Gold Price History Table (1970s – 2025)

This table reflects how gold has steadily risen over time, particularly during periods of high inflation or geopolitical instability. Gold’s recent surge to $2,954 per ounce highlights its role as a vital store of value in uncertain times.

Gold Price Trends: A Deeper Dive

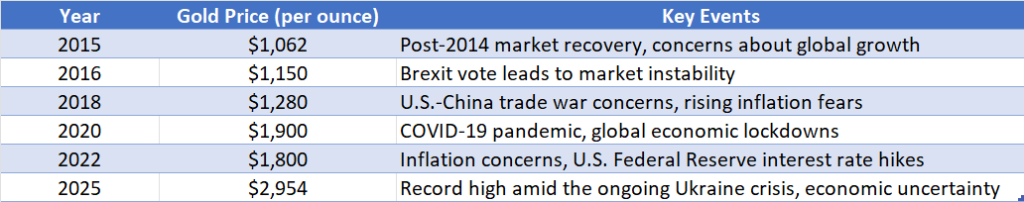

Let’s take a closer look at how gold has performed in recent years, especially during moments of economic or political uncertainty. The following table highlights notable price fluctuations over the past decade, particularly during key geopolitical and economic events.

Gold Price Trends (2015-2025)

Gold’s steady price rise from 2015 to 2025, with notable surges during geopolitical events such as Brexit, the U.S.-China trade war, and the COVID-19 pandemic, reflects its resilient nature as a safe haven.

Why Is Gold So Resilient?

Gold’s resilience and ability to withstand market fluctuations can be attributed to several key factors:

- Intrinsic Value: Gold has been prized by civilizations for thousands of years due to its rarity, durability, and beauty. Unlike paper currency, gold is not subject to inflationary pressures, making it a preferred store of value.

- Limited Supply: The supply of gold is relatively finite. While there have been advances in mining techniques, the total amount of gold that can be extracted from the earth is limited, making it inherently more valuable as a scarce resource.

- Global Demand: Beyond being an investment vehicle, gold is used in various industries, including electronics, jewelry, and even in medical applications. This demand keeps gold valuable across different sectors, stabilizing its price.

- Political Uncertainty: During times of political instability, such as the ongoing tensions in Ukraine, investors flock to gold as a hedge against currency fluctuations and government instability. In the case of an economic downturn, gold tends to rise in value, making it an attractive investment during times of crisis.

Gold Price Charts and Analysis: A Historic Peak

To better understand the dramatic rise in gold prices, let’s examine a gold price chart over the past few decades:

Chart: Gold Price from 2000 to 2025

This chart shows the significant upward trajectory in the price of gold. From a modest $290 per ounce in 2000 to the record high of $2,954 in 2025, the increase has been substantial, with notable spikes during periods of market uncertainty and geopolitical instability.

The Future Outlook for Gold

With geopolitical tensions showing no sign of abating in 2025, it’s safe to assume that gold will continue to be in high demand. The U.S.-Ukraine conflict, combined with increasing tensions between other global superpowers, may lead to even further spikes in gold prices in the coming months.

However, it’s important to note that gold prices are also subject to other factors. Central bank policies, especially those of the U.S. Federal Reserve, and fluctuations in interest rates can significantly impact gold’s price. For instance, if central banks raise interest rates to combat inflation, gold might experience a temporary drop as bond yields become more attractive.

Nevertheless, as long as geopolitical instability persists, gold will likely maintain its role as a go-to safe-haven asset.

Gold as an Investment: How to Get Involved

Investing in gold can be done in several ways:

- Physical Gold: Purchasing physical gold in the form of coins, bars, or jewelry is one option. While it provides tangible ownership, it also requires secure storage and insurance.

- Gold ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds are a popular choice for investors who want exposure to gold without the need to physically own it.

- Gold Mining Stocks: Investing in stocks of gold mining companies provides an indirect way to gain exposure to gold prices. As gold prices rise, the profitability of these companies also tends to increase.

- Gold Futures: Advanced investors can consider trading gold futures, which allow them to speculate on the future price of gold. However, this can be highly risky and requires a good understanding of market movements.

Gold as the Ultimate Hedge

Gold has once again proven its status as the ultimate hedge against geopolitical tensions and economic instability. With its price reaching new heights, driven by the uncertain geopolitical climate of 2025, gold remains a valuable asset for investors seeking stability in times of global unrest.

Whether you’re looking to invest in gold directly, or simply interested in its historical significance and market trends, it’s clear that gold will continue to play a pivotal role in the global economy for the foreseeable future. As tensions rise, so too will the demand for this precious metal, ensuring its position as the ultimate store of value.